By 2025, India will be the world’s third-largest consumer market, with the largest middle class on the planet. By 2030, consumer spending should quadruple, thanks to a projected one billion residents who will then be online. If you want these people to buy from you, you have to translate your content.

Erroneously thought of as an "English-first" market, the country’s current 1.37 billion residents speak 122 distinct languages with 1,599 dialects written in 13 different scripts. Only ten percent of the population speaks English.

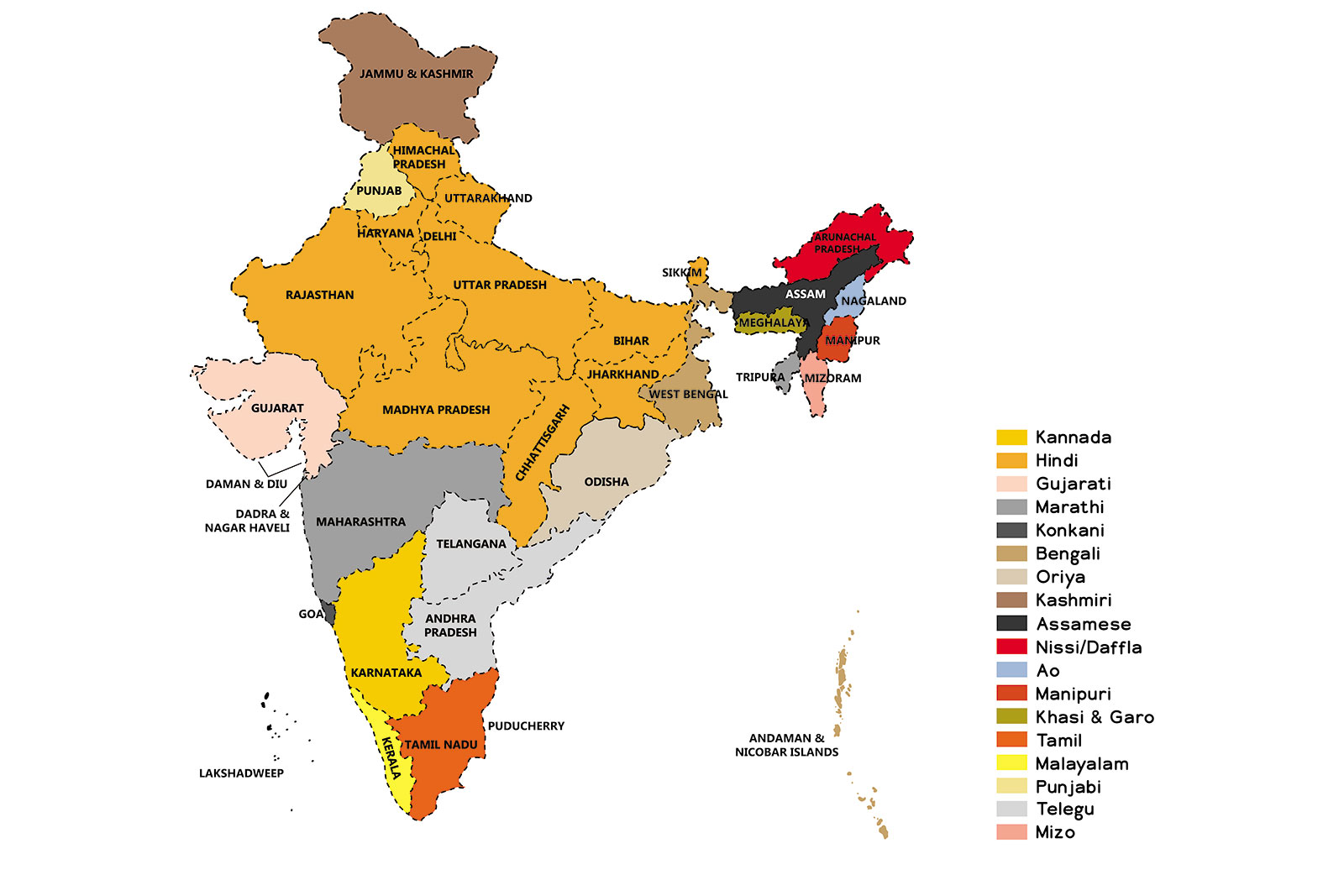

Figure 1: According to India’s constitution, the country itself doesn’t have a "national" language. Instead, there are 22 official tongues, which the Indian government calls "scheduled" languages.

So where do you start? How can translation buyers even dream of approaching such a linguistically diverse target market? Here are five key factors your company ...