From the late 1990s through 2019, the language services sector grew consistently because of an ever-increasing demand for translation and interpreting services. In 2020, industry revenues took a substantial hit, erasing almost two years of revenue increases. However, with a substantial rebound in growth in 2021 and 2022, it appeared to many as if historical trends would reassert themselves and “business as usual” would reassert itself.

But that isn’t what happened.

Based on quarterly confidence surveys with Language Service Providers (LSPs), reports of a widespread “buying pause” among enterprise consumers of language services, and reports from leading LSPs’ CEOs of substantial cuts in spending by their clients, CSA Research predicts that industry spending declined in 2023, going from US$52.01 in 2022 to US$51.85 billion in 2023.

Several socioeconomic factors contributed to this decline: economic uncertainty, war in Europe and the Middle East, trade conflicts between the United States and pretty much every country in the world, stubbornly high inflation, high interest rates, lingering pandemic restrictions – and new waves and variants of COVID-19 – in some countries, and fears of an ever-looming recession. Based on these, many enterprises opted to take a cautious approach and hold off on major investments.

At the same time, the explosion in popularity of generative AI (GenAI) that began with OpenAI’s launch of ChatGPT led to an irrational hype for all things AI and, in early 2023, several enterprises chose to dispense with their localization programs in favor of using GenAI as a translation tool. Although these tools are far from ready for serious enterprise use and have yet to truly integrate with translation technology stacks, the worry was that LSPs and corporate localization teams would soon go the way of the proverbial dinosaur. As a result, industry confidence has been in decline over the last year.

However, even though it is tempting to blame the language sector’s woes on these economic and social challenges, coupled with GenAI, the fact is that these only accelerated an existing trend in which machine and hybrid human-machine language services were displacing human-only offerings.

When asked about demand changes by service type in mid-2023, 40% of CEOs of large LSPs reported a decline in traditional translation and localization (which may include MT as an optional resource but does not rely on it), compared to just 29% citing an increase. In addition, 39% of large enterprise buyers have put a pause on localization spending for the next three quarters.

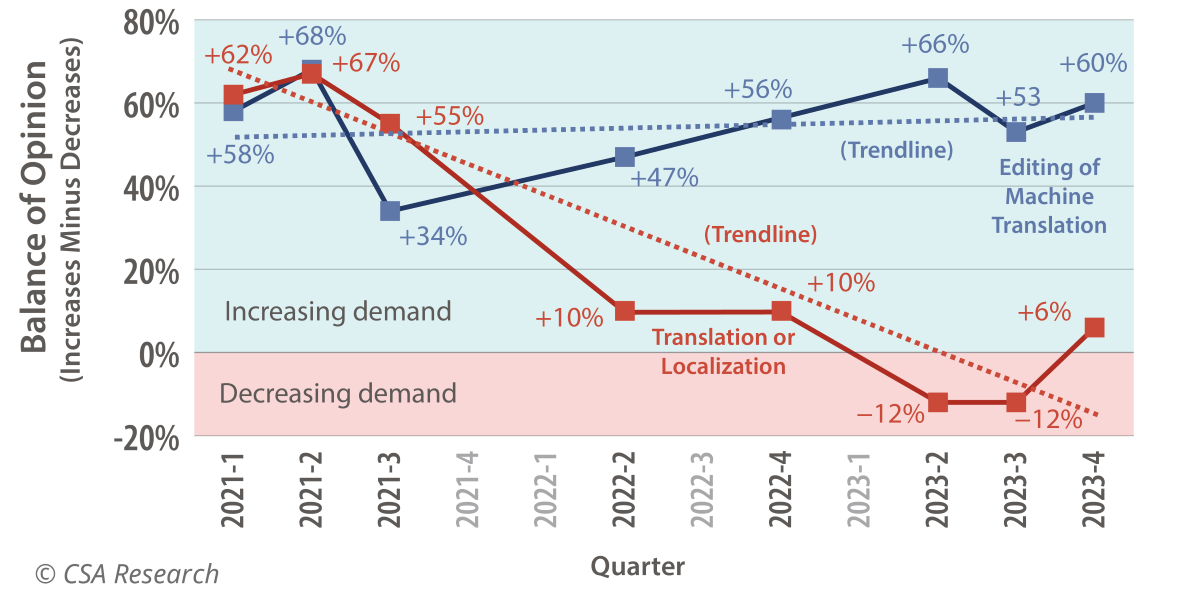

Subtracting the number of LSPs reporting a decline in demand for a service from those experiencing an increase delivers a “confidence score” that can identify the direction demand is heading for a service. From this perspective, the shift in demand toward machine-driven services is particularly striking and rapid: In 2021, both human translation (the red line in Figure 1) and MT editing (the blue line) experienced growing demand in the first half of the year. However, demand growth for human services slowed and then went negative in late 2022 or early 2023. By contrast, demand for MT editing has consistently grown and now has a confidence score that is 54% greater than that of human translation (up from a difference of 78% in early 2023).

Figure 1: Change in demand over time: human translation versus MT editing

What does post-localization mean for the language sector?

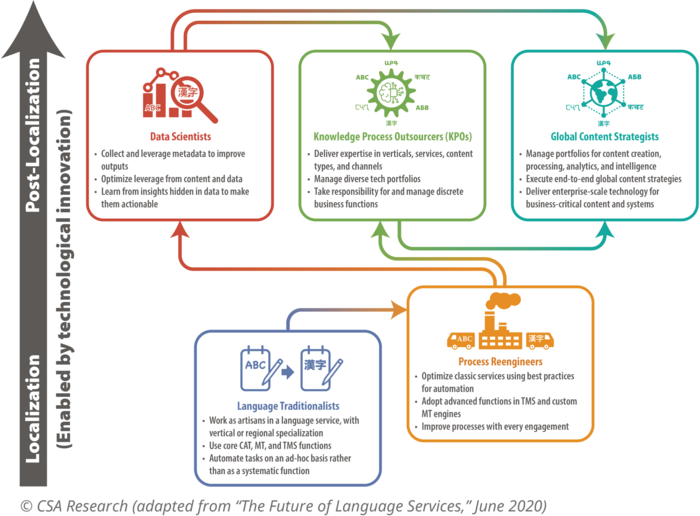

These factors demonstrate that the language sector has entered what CSA Research calls the “post-localization era.” Why “post-localization”? Simply put, “localization” described a period during which suppliers focused predominately on linguistic transformations such as translation and interpreting. These language-to-language operations will play a decreasing role as demand increasingly shifts to integrated “globalization” offerings that address all core aspects of a global business – marketing, support, digital experience, and other customer or internal-facing operations – with integrated offerings.

Here are some of the characteristics of this period:

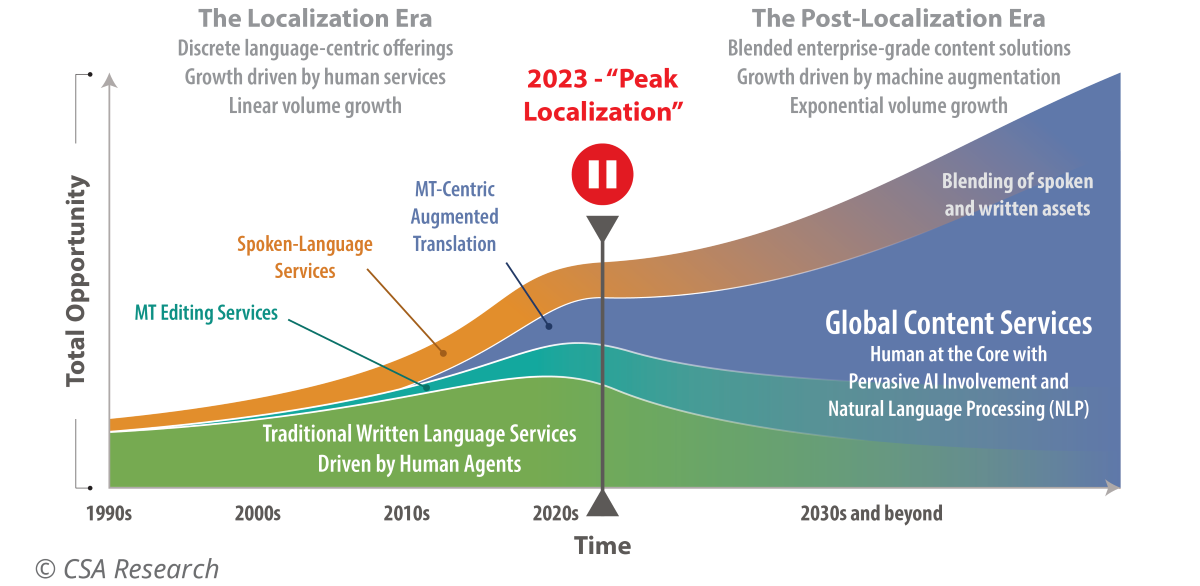

- Peak localization occurred in 2023. We identify 2023 as the year of “peak localization” and the start of the post-localization era, in which global content services will dominate (Figure 2). Although revenue growth paused in 2023, we see the potential for it to resume because of exponential growth in content volumes that require various transformations within and across languages.

Figure 2: Service boundaries blur in the post-localization era.

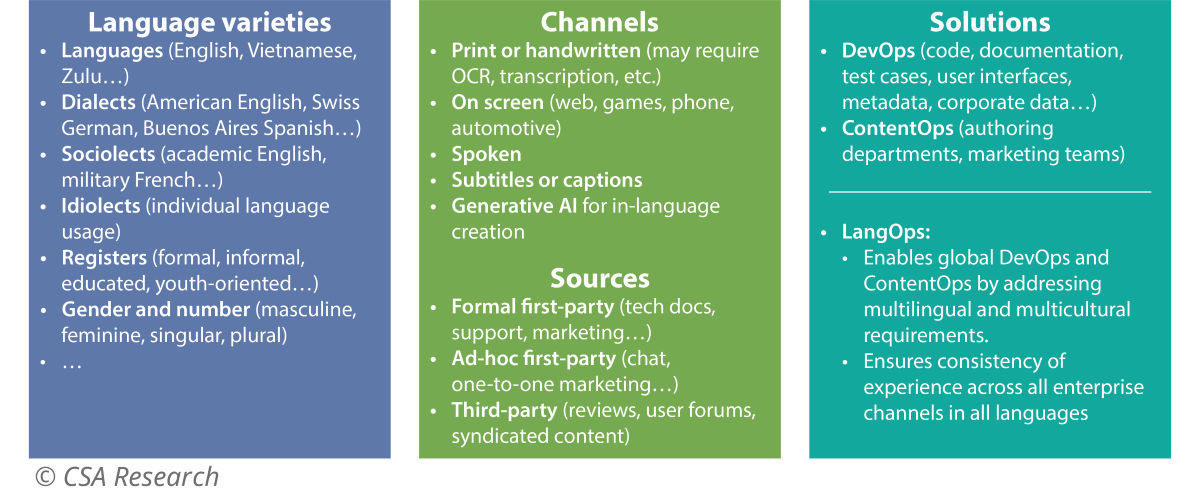

- Future growth will come from new areas that cross organizational boundaries. In contrast to the past, when the language services sector could rely on steady demand growth for traditional services, it must now grow into an industry that unifies the language-related aspects of ContentOps, DevOps, and any other enterprise business function with a variety of operational concerns, even as boundaries between these functions collapse. In this paradigm, LSPs must be tech-savvy and focused on delivering enterprise-grade services and value across multiple functional areas (Figure 3).

Figure 3: The expanding role of localization teams in global enterprises

Note: Leadership at many organizations believes that AI can displace language services. This factor will apply additional pressure on localization groups and LSPs to move to more automated solutions.

- Translation and interpreting will be subsumed into globalization. Post-localization does not mean that translation will go away. Far from it. Instead, translation will become part of a broader array of international content operations that cross multiple language varieties, channels, sources, and solutions. We identified many of these trends in 2020 in “Digital Transformation for LSPs.” [2] The 2023 decline in services based on primarily human effort signals a sea change for the language sector, which can no longer rely on steady growth on the back of translation alone.

The shift to post-localization services

Expanding on the last point in the previous section, LSPs and enterprise localization groups should not view this transformation as the end of the world. Instead, even as traditional localization recedes in importance, the scope of content to be translated or interpreted will increase dramatically. Language industry practices will need to change to address the scale, specialization, and complexity this shift will bring. In shifting to post-localization, all stakeholders – LSPs, enterprise localization teams, technology developers, and freelancers – need to recognize that the context in which they operate is evolving rapidly.

As a result, language professionals need to take the following steps to demonstrate their value, either to customers or internal stakeholders:

- LSPs and departments need to articulate their value beyond translation. Language professionals already do far more than simply port words from one language to another, whether they realize it or not. Their ability to manage a wide variety of linguistic assets, ensure consistency across tasks, and manage risk are things that AI cannot do on its own. They must shift toward providing ever more sophisticated value-added services such as managing culturalization or personalization, or carrying out tasks such as anonymization, summarization, or adaptation to meet legal and regulatory norms (Figure 4).

- Industry stakeholders must align their efforts. As part of articulating a value beyond translation, localization groups need to align their efforts with what their internal clients require, and LSPs need to assist them in doing so. Groups that focus on metrics for translation or interpreting risk being replaced by lower-cost services. Instead, discover what matters to the relevant stakeholders – including end users – and make certain that your offerings contribute to organizational goals.

- Move up the value hierarchy. Today’s LSPs face an existential imperative: They must step up their value or face increasing irrelevance. Enterprise localization groups must integrate into core business functions in a similar way, or they risk being bypassed by increasingly capable technology and departments that cannot and will not wait for outdated localization processes that do not meet their expectations. This does not mean that every LSP must become a Global Content Service Provider (GCSP) or that every localization group become an MT specialist, but they all must evolve to solve organization-level challenges.

Figure 4: Post-localization LSPs must offer additional value-added services

- Individuals need to determine – and convey – their offerings. Language professionals – including freelance linguists – face a similar challenge, but on a smaller scale. They must become comfortable working with machine-driven resources, even to the point of ceding some long-term functions to the software. Successful freelancers will need to deliver additional value and expertise in working with AI resources – offered by LSPs or on their own behalf – to benefit their clients (whether they are LSPs or direct end-clients). They must get comfortable using augmented translation and other approaches that work with MT.

Note: Individuals with uncommon expertise – in a domain, with a technology, or in dealing with specific processes – will have an advantage as the post-localization era unfolds. Generalists will discover that increasingly capable AI will replace them in many functions. By contrast, specialists – especially those with experience in using generative AI – will be in increasing demand. This dynamic is analogous to the medical profession, where surgeons become experts in particular procedures rather than conducting all possible surgeries.

- LSPs – and enterprise localization teams – must reconceptualize their role. LSPs will face challenges as they pivot to support the organizational mandates and changes described in Figure 4. Similarly, enterprise language services groups will have to break out of a document-centric world to address content everywhere. This transition will require substantial modification to long-held business practices and expectations for what they deliver. It needs the development of new value propositions and processes that meet enterprise requirements for trust, scalability, security, and applicability.

What comes next?

The shift to post-localization will not be instantaneous, but technological developments are pushing it forward at a speed unimaginable just a few years ago. We are witnessing a perfect storm of factors that will force providers and buyers alike to confront the implications of this sea change in the language sector. Sitting aside and waiting for things to return to normal is a recipe for disaster.

We forecast that industry growth will be slow for the next few years by historical standards, perhaps even negative after accounting for inflationary pressures that devalue earnings more and more each year. Industry productivity will increase dramatically as LSPs incorporate more and more AI technology into their technology stacks, and this improved efficiency will make language services more attractive to enterprises as a way to extend their reach. However, these services will be more varied and more targeted to specific tasks beyond translation and buyers will increasingly expect and assume that providers will be using GenAI and Neural Machine Translation to keep costs down. This means that per-word rates will continue to erode, even if spending goes up.

The current situation is particularly tough for small- and medium-sized LSPs that lack the capital for large-scale investment in technology. The CEOs we speak to frequently cite US$1,000,000 as the minimum annual investment to be marginally competitive in AI, an amount that is beyond most providers’ capacity. But this situation is changing as TMS developers and pure-play technology developers are building AI capabilities into their tools. Right now, the large LSPs have an advantage, but within a few years, GenAI will be “table stakes” for the language sector. Until we reach that point, however, expect to see continuing revenue challenges for smaller players. Those that can stay the course and adapt to shifting demand will see brighter days.

Ultimately, the migration to post-localization will benefit the language sector, which will be involved in far more enterprise activities that will elevate its services to core business activities. Its improved efficiency will help it and its customers begin to address the truly enormous gap between what needs to be available across languages and what can be translated today. This all means that post-localization will increase industry revenue and importance, but realizing these advantages will take time and effort.